Monthly Market Insight December 2021

UK and EU commodity prices hit new record highs.

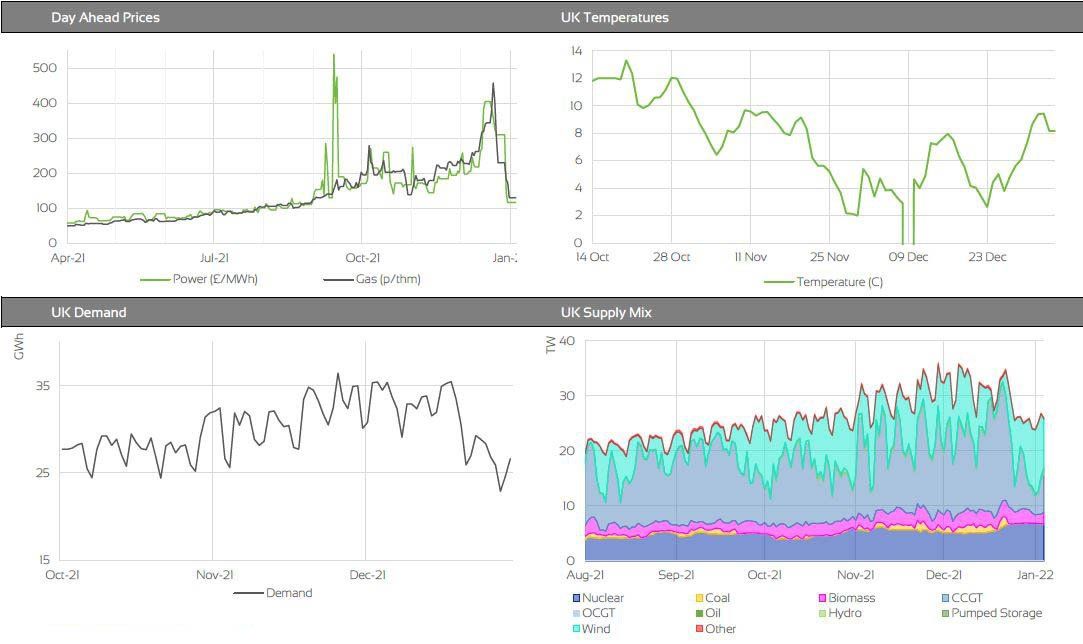

Key Market Drivers

- Front seasonal contracts experienced intra-month increases of 184% and 126% for gas and power respectively.

- Wave of LNG imports forecast for early 2022, easing curve prices late in the month.

- Early cold temperature forecasts and poor Russian gas supply supporting intra-month upside.

Market Prices

Market Insight: Short-Term

Front month gas and power contracts experienced unprecedented levels of upside movement and volatility throughout December, with ongoing gas supply concerns, colder weather forecasts and French nuclear availability feeding bullish sentiment. Front month contracts peaked as high as £575.00/MWh and 470.49p/thm, trading in a price range of £365.00/MWh and 311.86p/thm for power and gas respectively. Most upside movement occured during a 2 week period on the lead up to Christmas, with colder temperature forecasts, low Russian gas supplies and record low gas storage levels exacerbating ongoing supply concerns.

Nonetheless, between Christmas and New Year, markets reversed the upside, losing strength off the back of a changing fundamental outlook. A milder weather outlook and vastly improved LNG schedule weighed considerably on prices. NBP and TTF prices traded at a premia to the JKM equivalent throughout this period, increasing competition for LNG volume, in turn diverting numerous cargoes to new European bound destinations.

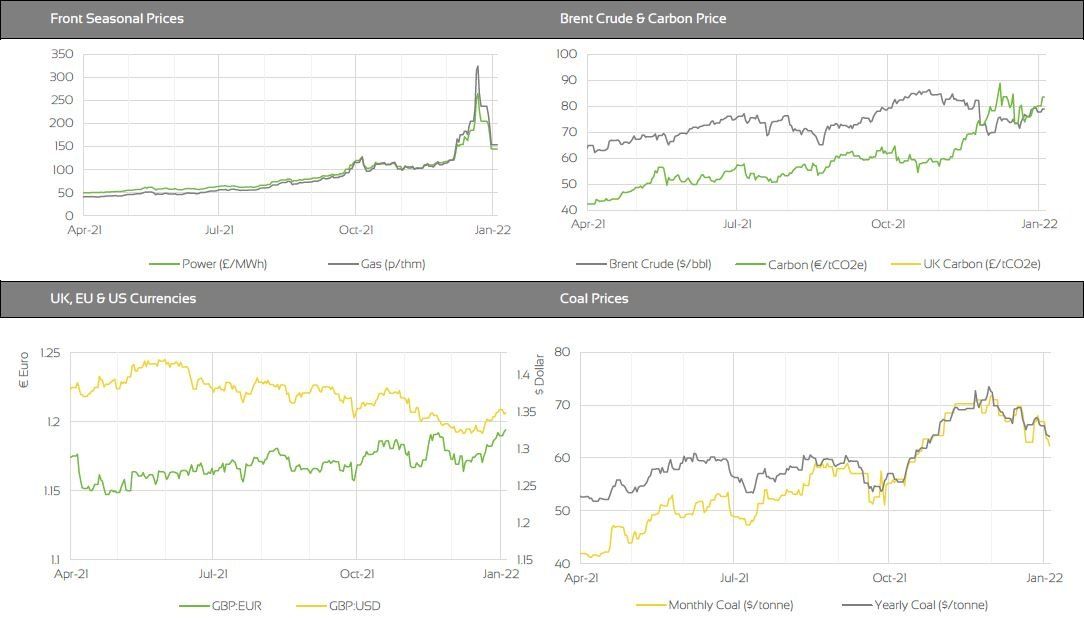

Market Analysis: Long-Term

Market Insight: Long-Term

Seasonal contracts were subject to similar movements as near-term curve products, with temperature, LNG, gas supplies and nuclear availability driving prices. UK gas and power curve prices have been subject to increased levels of volatility, trading in a somewhat reactive fashion with a reduced impact from the wider commodity complex.

December bullishness has been driven by initially cooler weather forecasts but also gas flows along the Yamal pipeline, which connects mainland Europe and Russia, seeing flows turn eastward, further limiting European supply and exacerbating upside pressure. French nuclear availability lost a significant portion of generation for January, supporting bullish momentum, as 17 out of France's 56 nuclear plants had ceased production due to planned maintenance or technical problems, with cracks detected on pipes of the Civaux power plant in Western France.

Month-on-month, front seasonal contracts have moved up by 23.4% and 35.3% for power and gas respectively, despite seeing intra-month

increases of 184% and 126% for gas and power respectively.

Market Outlook

With increasing levels of volatility, both the near and far curve should expect large price swings over the coming weeks. Despite temperatures currently forecast in line with seasonal norms, January and February are typically subject to cooler periods and all eyes will be on the supply/demand balance across Europe. Wind and temperature forecasts for the UK remain in line with seasonal norms at present, but can be subject to revisions.

Nord Stream 2 could now get approved in the middle of the year, which should ease supply concerns and increase gas flows into mainland Europe, however, the main concern resides around the remainder of the Win-21 period and supply levels in the event of colder weather.

For the wider commodity complex, OPEC+ are set to meet today to discuss output levels, with expectations that members will agree to stick to planned increases for February as Omicron appears to be having limited impact on demand levels. There has been an increase in output of 400,000 bpd (barrels per day) from OPEC and allies since August 2020.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.