Energy Market Insight | June 2024

Energy Market Trends: JUNE 2024

ENERGY MARKETS IN JUNE FELL DESPITE VOLATILITY

WHAT ARE THE SHORT-TERM ENERGY PRICE IMPACTS?

Short-Term ENERGY MARKET TRENDS & INDICATORS

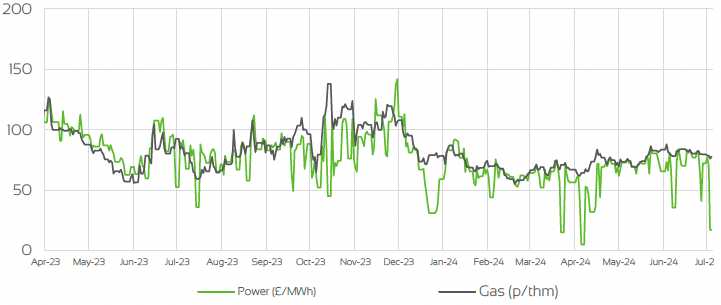

Day Ahead GAS & POWER Prices

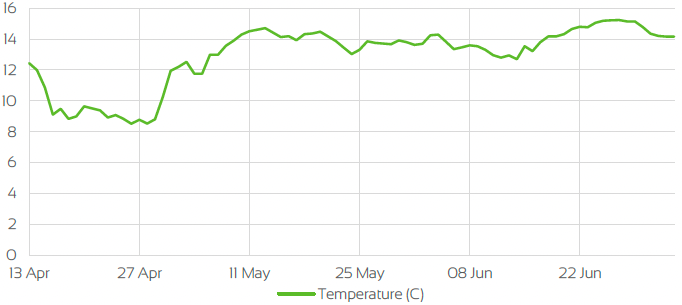

UK Temperature CHANGE

Market Insight: Short-Term

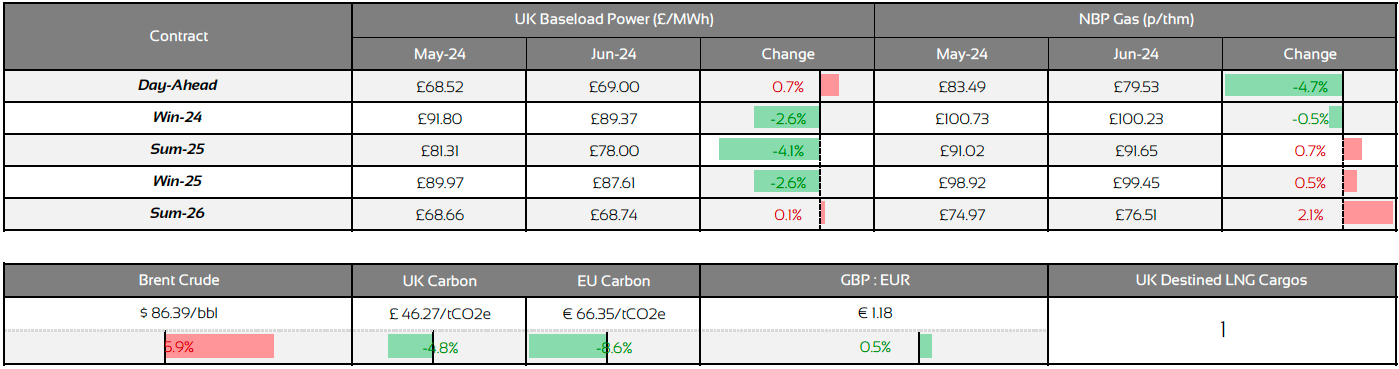

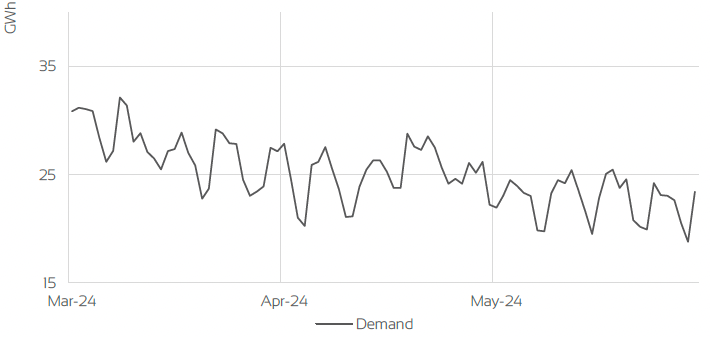

Despite prices across both the near and far curves falling over the month of June, contracts overall experienced volatility throughout, as supply concerns in regards to LNG and unplanned outages caused premiums to creep back in. Come the end of June both power and gas markets for July, August & September contracts were down as stable supply, reduced demand and healthy storage injections added much of the bearishness.

With that said early parts of the month were overshadowed by unplanned outages in Norway which impacted nominations to both the UK and Northwest Europe. Large gas facilities such as the Nyhamna plant experienced outages which were also extended and added further upside into contracts.

Exacerbating supply concerns, were LNG imports as Asian demand for the fuel remained high due to the continued heatwave which in turn increases cooling demand in the region. This pushes up the price for LNG cargo with Europe having to bid higher for the fuel, but due to reduced demand and storage levels already at a high for this time of the year, immediate concerns were downplayed as storage injections (LNG send out) remained healthy.

Though longer-term concerns were still apparent as LNG imports were limited. Storage levels by the end of the winter period were close to 50% fullness and by the end of June, sat comfortably above the 76% mark and looks on course to hit the 90% target by November. Further losses were limited as Russian gas flows to parts of Europe were at risk due to ongoing sanctions from the EU and potential payment delays, which added bullish sentiments into the short-term outlook. With both bullish and bearish fundamentals playing a part throughout the month, volatility has been apparent throughout keeping losses at bay despite winter preparations seemingly healthy.

WHAT ARE THE LONG-TERM ENERGY PRICE IMPACTS ?

LONG-Term ENERGY MARKET TRENDS & INDICATORS

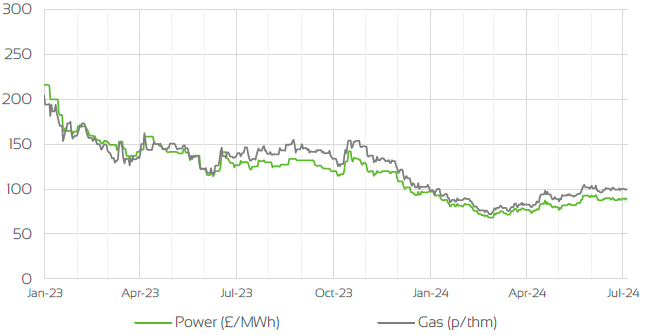

Front Seasonal gas & power Prices

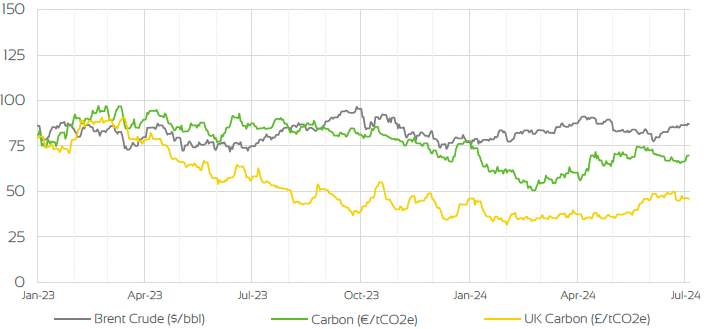

Brent Crude & Carbon Price

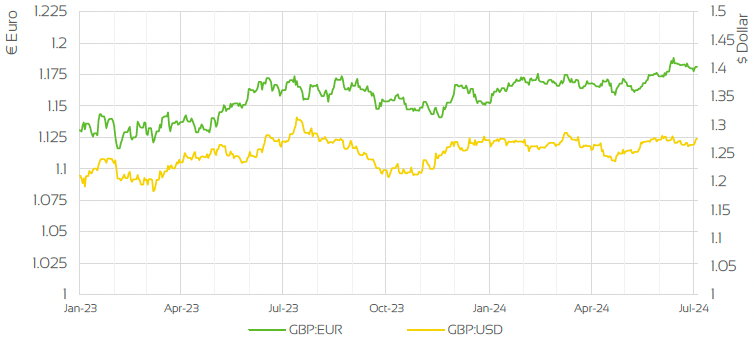

UK, EU & US Currencies

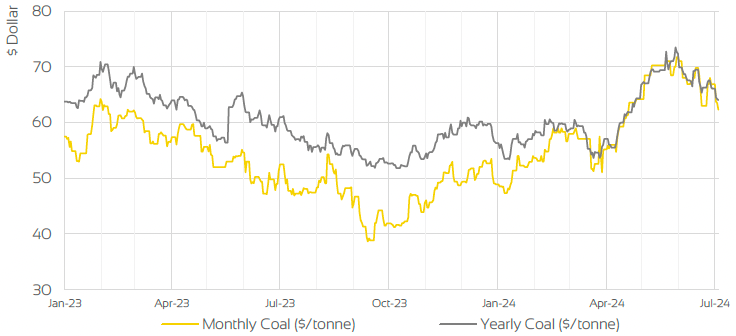

Coal Prices

Market Insight: Long-Term

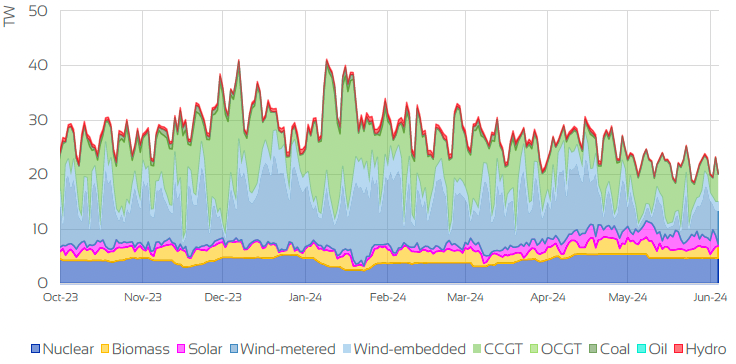

Seasonal index’s were also down overall by the end of the month as both Winter-24 and Summer-25 were down for both gas and power. Gas prices for winter-24 had crept over the 100p/Therm mark for the first time this summer, with power prices not far off from the £100/MWh mark. Despite storage levels in Northwest Europe sitting in a strong position, the ongoing heatwave in Asia continued to add bullish sentiment into longer-term markets as LNG imports throughout the month were relatively muted due to the higher spot prices from Asia. As mentioned, storage injections were steady throughout the month, as demand was somewhat muted due to temperatures sitting above seasonal norms throughout June, and with wind generation largely stable, gas demand for power remained at bay.

Norwegian gas flows were a concern at the beginning of the month, but as unplanned and planned outages slowly drew to a close, nominations had recovered towards the latter part of the month sitting comfortably above the 300 MCM/d. With no further reports of any significant outages from Gassco, any remaining concerns surrounding Norwegian supplies were limited. Therefore, leaving the supply outlook beyond the summer months for the time-being looking relatively stable. On the wider commodity complex, oil has seen a steady incline throughout the month, as summer demand expectations, OPEC+ production cuts and suggestions that the U.S Federal Reserve could cut interest rates.

These bullish fundamentals have offset much off the demand concerns on the back of economic growth amongst developed nations, leaving prices above the $85/Bbl mark.

Market Outlook

At the beginning of the summer period, circumstances did suggest there could be further downside as we moved deeper into the season, but the last couple of months has seen prices largely reverse as supply concerns around Norwegian gas flows and LNG added bullishness into markets. Wider risks from geopolitical fundamentals have also exacerbated concerns and therefore supported a lot of the upside we have seen in recent months. This is despite storage levels being comfortable and the supply outlook overall being stable and looking on course to be in a healthy position come the winter period.

As we draw closer to the winter months, the outlook could favour the bullish side for the time-being with LNG demand from Asia keeping traders on the cautious side. Upside support from outages still ongoing from the LNG facility in Texas will remain a concern as time passes. Added pressure from hedging for the winter period is also likely to add bullish sentiment into contracts as we edge closer to winter. With that said gains could be capped if storage replenishment continues to be steady and Norwegian supplies are uninterrupted.

Related News

EXPLORE OUR OTHER ENERGY MARKET INSIGHTS

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.