Energy Market Insight | August 2024

Energy Market Trends: AUGUST 2024

Markets edge higher amid short-term supply risks

WHAT ARE THE SHORT-TERM ENERGY PRICE IMPACTS?

Short-Term ENERGY MARKET TRENDS & INDICATORS

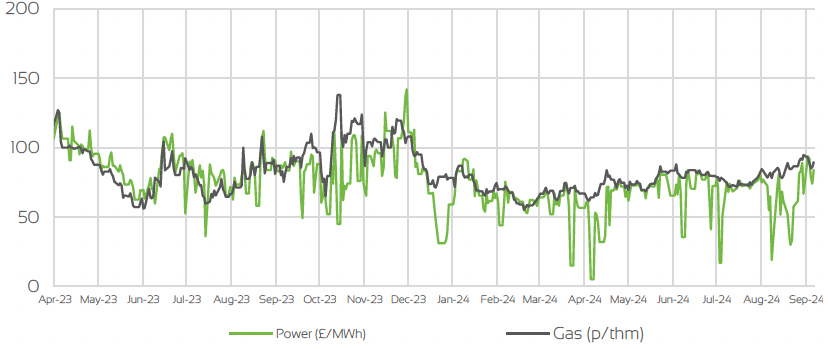

Day Ahead GAS & POWER Prices

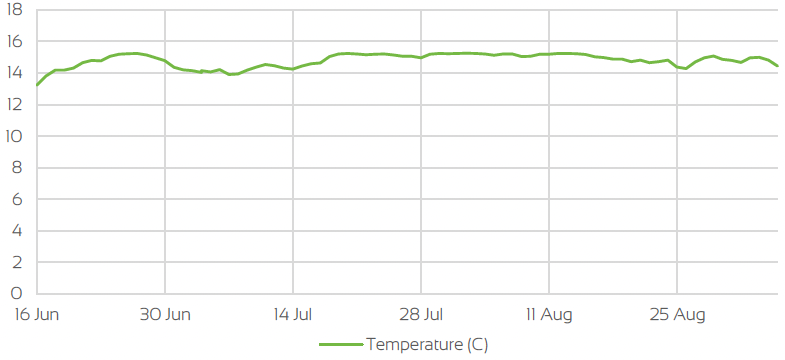

UK Temperature CHANGE

Market Insight: Short-Term

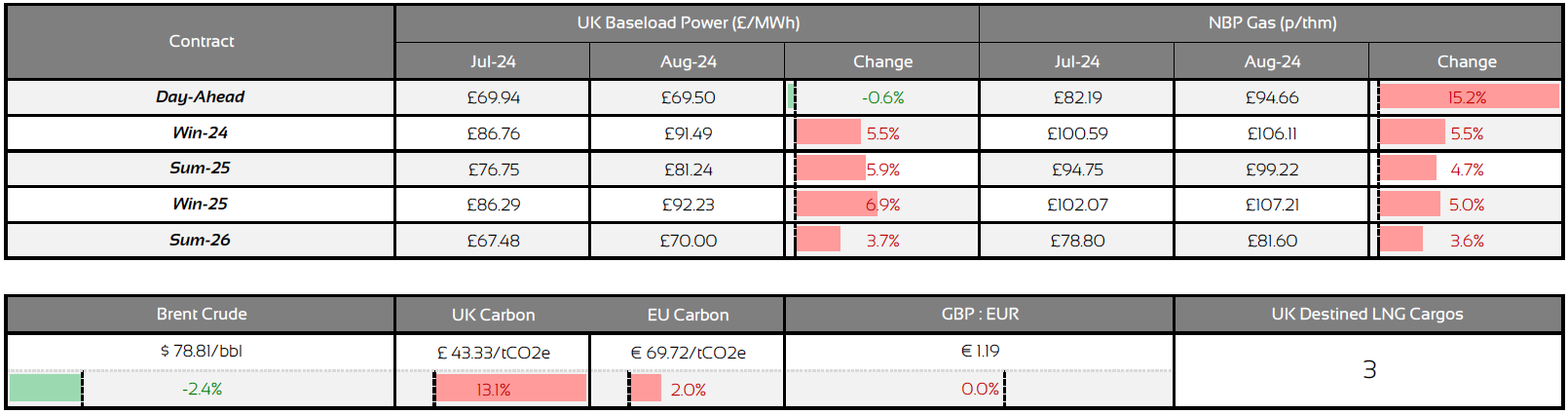

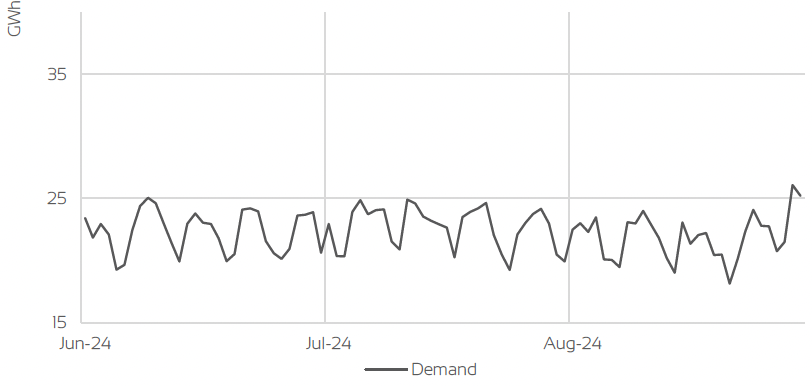

August has been a month of bullishness across the curve on both gas and power prices. Despite preparations for the winter period on schedule and looking healthy come October, markets have edged higher overall. Wider supply concerns coming from the wars in Ukraine and the Middle East have been a focus throughout August, as fighting close to a key supply area (Sudzha), where Russian gas flows still enter Europe via Ukraine.

Fears of supply being disrupted were the main concerns, but flows remained stable as initial fears eased as the month drew to an end. Contractually, most of Russian gas flowing through Ukraine is going to end at the beginning of January. Norwegian gas flows for the majority of the month were largely stable but focus shifted to the annual scheduled maintenance works which began in the latter weeks of August.

This meant during the peak of the outages, only a third of what is normally delivered would be available to the EU and the UK which will continue into September. Large facilities such as Kollsnes, Karsto and Nyhamna are all set for a period of shutdown. With that said, storage replenishment in Northwest Europe for the winter period hit the November target of 90% which helped limit any further gains, as storage injections continued to be stable and uninterrupted.

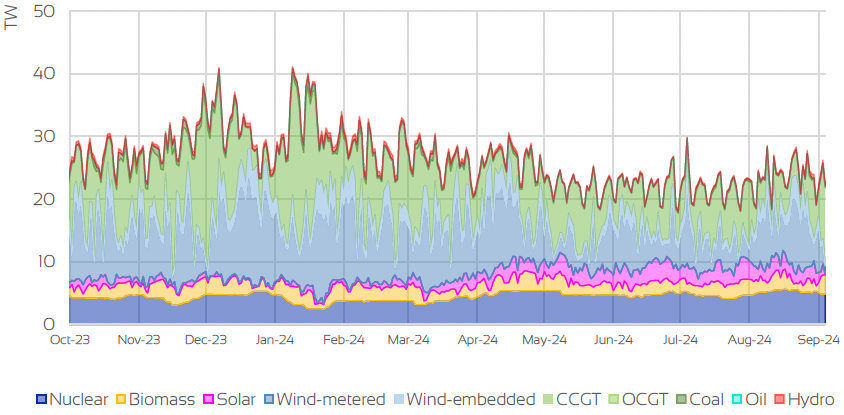

By the time the month ended storage levels were comfortably above the 90% mark, sitting at 92% fulness. Wind generation has been somewhat stable and less volatile compared to previous months and has helped alleviate some of the pressures of reduced flows coming from Norway which was also a slight concern earlier in the month.

WHAT ARE THE LONG-TERM ENERGY PRICE IMPACTS ?

LONG-Term ENERGY MARKET TRENDS & INDICATORS

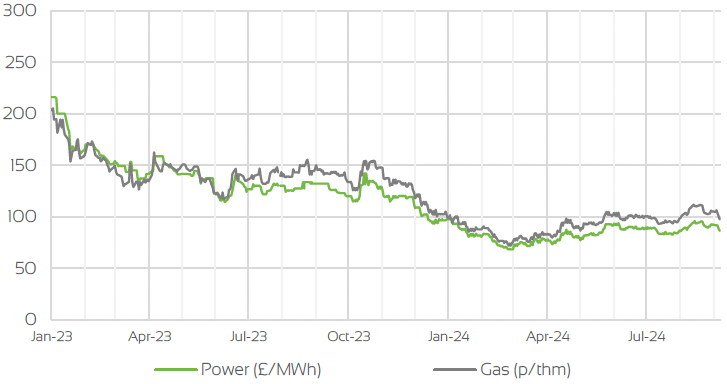

Front Seasonal gas & power Prices

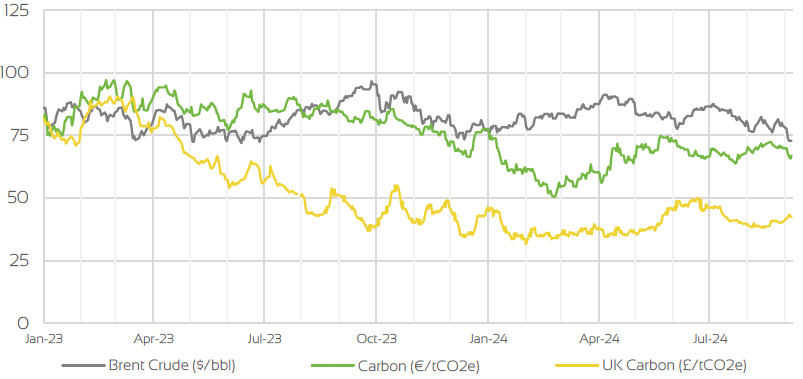

Brent Crude & Carbon Price

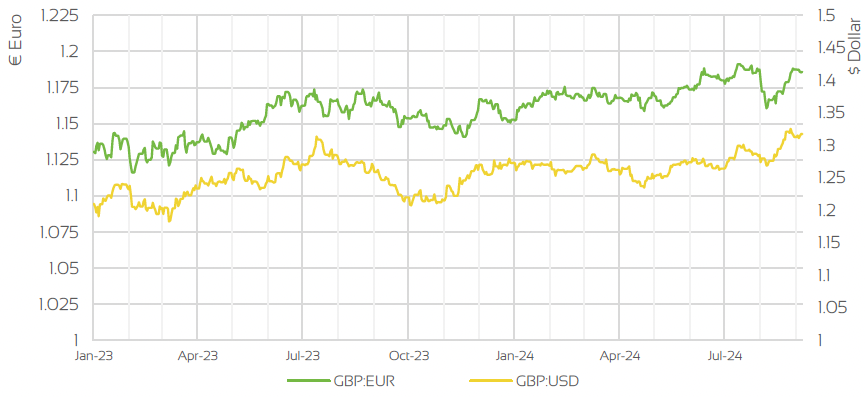

UK, EU & US Currencies

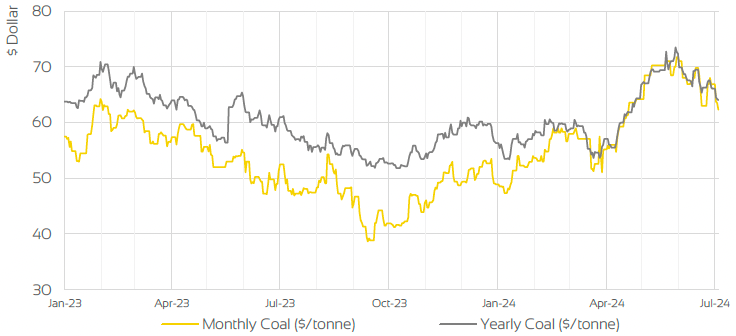

Coal Prices

Market Insight: Long-Term

Front seasonal contracts were on the up and followed in similar fashion to the monthly indexes, as wider supply risks supported much of the gains throughout August. With both wars in Ukraine and the Middle East having previous concerns resurfacing i.e. war spreading across the Middle Eastern region and disruptions to Russian gas flows via Ukraine, the likely hood of fighting coming to an end does not seem likely for the time-being. This is in turn will continue to fuel longer term supply risks/concerns to LNG imports and Russian gas that still supplies parts of Europe. With winter only a month away, and with short-term risks on the back of Norwegian maintenance and some minor LNG outages in Australia, further bullish sentiment would have crept back into markets, supporting the uptrend in prices.

On the wider commodity complex, Brent/Crude markets were relatively rangebound by the end of the month but experienced volatility throughout, and supply and demand concerns offset each other. Supply woes continued as fighting in Israel caused fresh concerns around the war spreading, and with talks of another ceasefire being premature any signs of future calm in the coming weeks and months seem unlikely for the time being. Demand has also been weak as two of the world’s largest users (U.S.A and China) are still showing weak economic growth and no real signs of improvements, which has helped offset some of the supply concerns. With OPEC+ also reporting on production increases from October, further downside could be on the horizon.

Market Outlook

With the winter months now only a monthly away, and gas storage targets already met, the supply outlook for Winter-24 looks healthy at the moment, and with storage being at 92% at the end of August, hitting 100% could be a possibility come October. Despite the ongoing geopolitical risk in Ukraine and Israel, the market outlook as a whole looks relatively healthy, with Norwegian flows stable albeit reduced amid annual maintenance works. As we approach the winter period, focus will turn to temperatures and the current situation regarding LNG imports as Asian demand is likely to change on the back of recent heatwaves in the region throughout the summer. Traders will also keep a keen eye on the operations at the Freeport LNG facility in Texas as it continues to recover from recent repairs.

As a lot of the premiums on the back of the geopolitical risks already priced into both short- and longer-term contracts, the market outlook some would suggest, could be edging towards the bearish side. With a healthy supply outlook for the winter along with Norwegian maintenance works seemingly going to plan (without any major extensions), there could be some downwards pressure on both the gas and power markets as we edge closer to October.

Related News

EXPLORE OUR OTHER ENERGY MARKET INSIGHTS

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.